Thailand’s Board of Investment (BOI) has been busy this year. Between a sweeping incentive package approved on 19 May 2025, rising application numbers, and a new international road-show, the policy signals are clear: Bangkok wants high-tech, sustainable projects and balanced growth that still protects local industry. Below is a concise round-up you can share with partners or investors evaluating a Thai expansion.

Key Measures From May's Meeting

| Measure | New Benefit / Rule | Why It Matters |

|---|---|---|

| SME Capability-Upgrade Scheme | 5-year 100 % CIT exemption (previously 3 yrs / 50 %) for Thai-owned SMEs investing in automation, energy efficiency or sustainability. | Doubles the tax cushion available to domestic JV partners or suppliers. |

| Oversupply & Trade-Risk Safeguard | BOI withdraws incentives for sectors facing global oversupply or anti-dumping actions (e.g., solar panels, lead-acid batteries, certain downstream steel products). | Signals that incentives will focus on strategic, not saturated, industries, whilst protecting Thai Market |

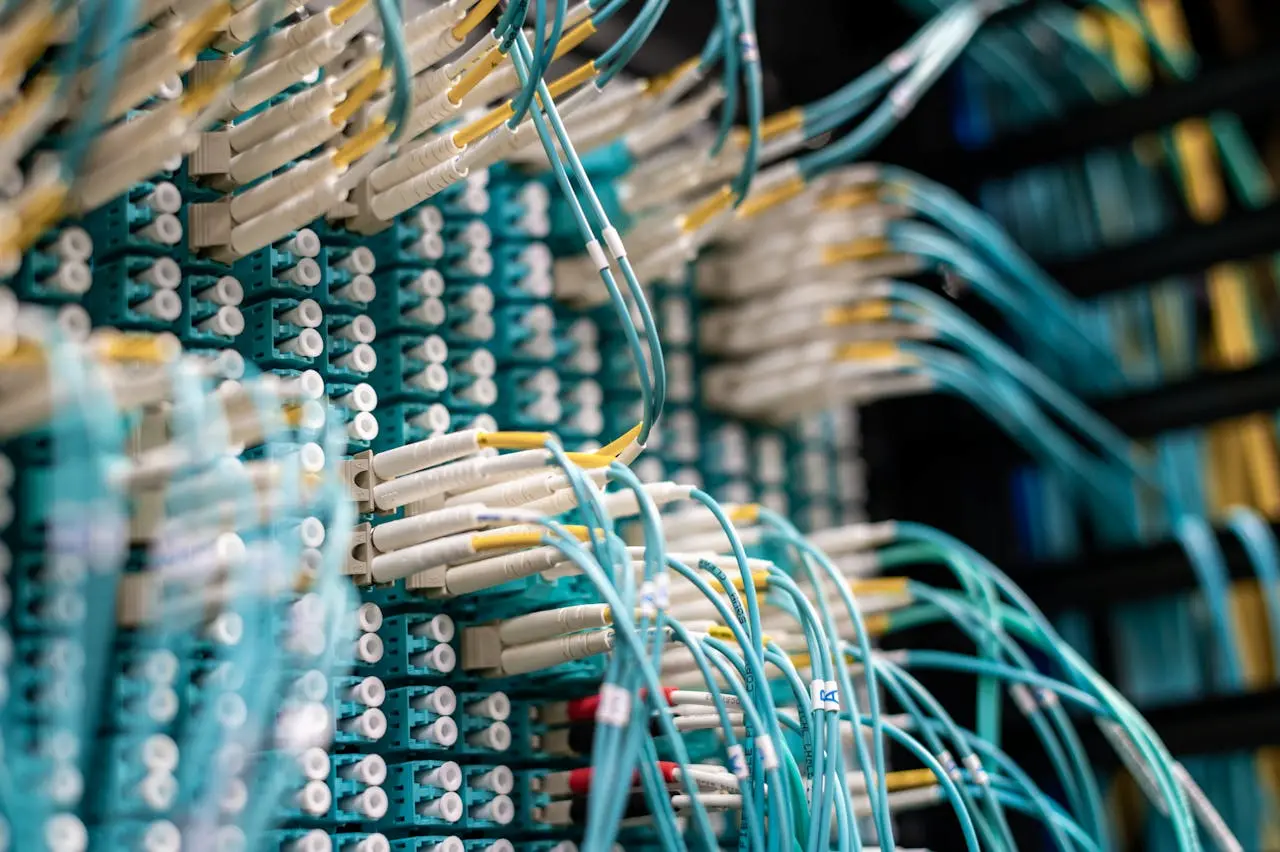

| Data-Centre / Cloud Overhaul | 8-year CIT holiday reserved for facilities that meet stringent PUE targets and offer GPU/HPC capacity; others capped at 5 years. Applicants must lodge a Thai-talent development plan before being considered for the policy. | |

| Tourism in 55 Second-Tier Provinces | Large attractions & infrastructure: 8-year CIT (up from 5). Hotels: 5 years (up from 3). Dependent on industry and business activity. | Encourages dispersal of tourism spend beyond crowded hubs. |

| Workforce Balance | Manufacturing companies that are BOI-promoted firms with ≥ 100 foreign staff must keep ≥ 70 % Thai employees; fast-track visas require min. salaries of THB 150k (executives) / THB 50k (specialists). | Aims to upskill locals while still welcoming high-value foreign expertise. |

Investment Momentum: Q1 2025 Snapshot

-

THB 431 billion worth of promotion applications (+97 % YoY).

-

Digital (฿ 94.7 bn) and electronics (฿ 87.8 bn) led the pack.

-

Hong Kong, China and Singapore topped the FDI table.

Taking the Message Global: BOI 2025 Road-show

BOI teams will court semiconductor, EV and digital-tech investors in Taiwan (Jun), Japan (Aug) and the United States (Sep). Secretary-General Narit Therdsteerasukdi says the aim is to lock in supply-chain partners for advanced electronics and AI-driven industries.

Upcoming Touch-point for EU Firms

What This Means for Investors

-

Incentives are now more surgical. Full tax holidays increasingly hinge on energy efficiency, workforce localisation and genuine tech transfer.

-

Local partnerships matter. The SME upgrade scheme sweetens the pot for Thai JV structures, especially in automation and green retrofits.

-

Look beyond Bangkok. Second-tier provinces offer longer tax holidays and, often, lower land costs.

-

Plan early for talent. Budget for new salary floors and be ready to document Thai-staff development to secure visa fast-tracks.

-

Engage during the road-show. Face-time with BOI officials can clarify grey areas—particularly around data-centre PUE benchmarks or sector-specific oversupply lists.

How Attori Law Can Help

-

Feasibility & activity-code mapping—pinpoint the BOI category that maximises benefits while avoiding restricted-business pitfalls.

-

Robust e-application drafting—we prepare the financial projections, workforce plans and environmental disclosures BOI now scrutinises.

-

Board-presentation coaching—tailored Q&A prep to satisfy sector experts on the BOI panel.

-

Post-approval compliance—ongoing reporting, condition monitoring and renewal support.

Every project is unique—our first step is a free eligibility check.

Starting or growing a business in Thailand can seem complicated, but it doesn’t have to be. We’re here to guide you every step of the way and make sure your legal and regulatory foundations are solid — so you can focus on what matters most: your business.

If you have any questions or want to learn how we can help, feel free to reach out for a free consultation.

[email protected] | +66 843 488 895 | www.attorilaw.com