Personal Income Tax

In Thailand, personal income tax is levied on individuals’ income and is based on a progressive tax rate system. Deciding on whether you need to pay tax or not depends on a few aspects: amount of income received, deductibles, tax residency status and source of income. Tax returns are made through the PND 90 form for those that must pay tax and PND 91 form for those who are not required to pay tax but need to submit their income to the revenue department.

Types of Income Subjected to Personal Income Tax

Salary and Wages:

Income earned from employment, including bonuses, allowances, and other compensation.

Business Income:

Profits derived from self-employment, freelancing, or similar operations.

Rental Income:

Income from renting out property or assets.

Annuities:

Income received from retirement plans or pension funds.

Dividends:

Earnings received from shares or stocks in companies, subject to specific tax rules.

Interest:

Interest earned from savings accounts, fixed deposits, and other investments.

Licensing:

Income received from licensing agreements for the use of intellectual property, such as patents or trademarks.

Capital Gains:

Profits from the sale of assets like stocks, bonds, or real estate, though capital gains tax applies differently depending on the asset.

Our Personal Income Tax Services

Attori Law offers personal income tax services in Thailand, including PND 90 and 91 filings. Our experts can help you save money by finding you the most beneficial tax deductions and by streamlining tax compliance. We help maximize savings for expatriates, investors, and Thai nationals.

Free Consultation

Personal Income Tax Rates

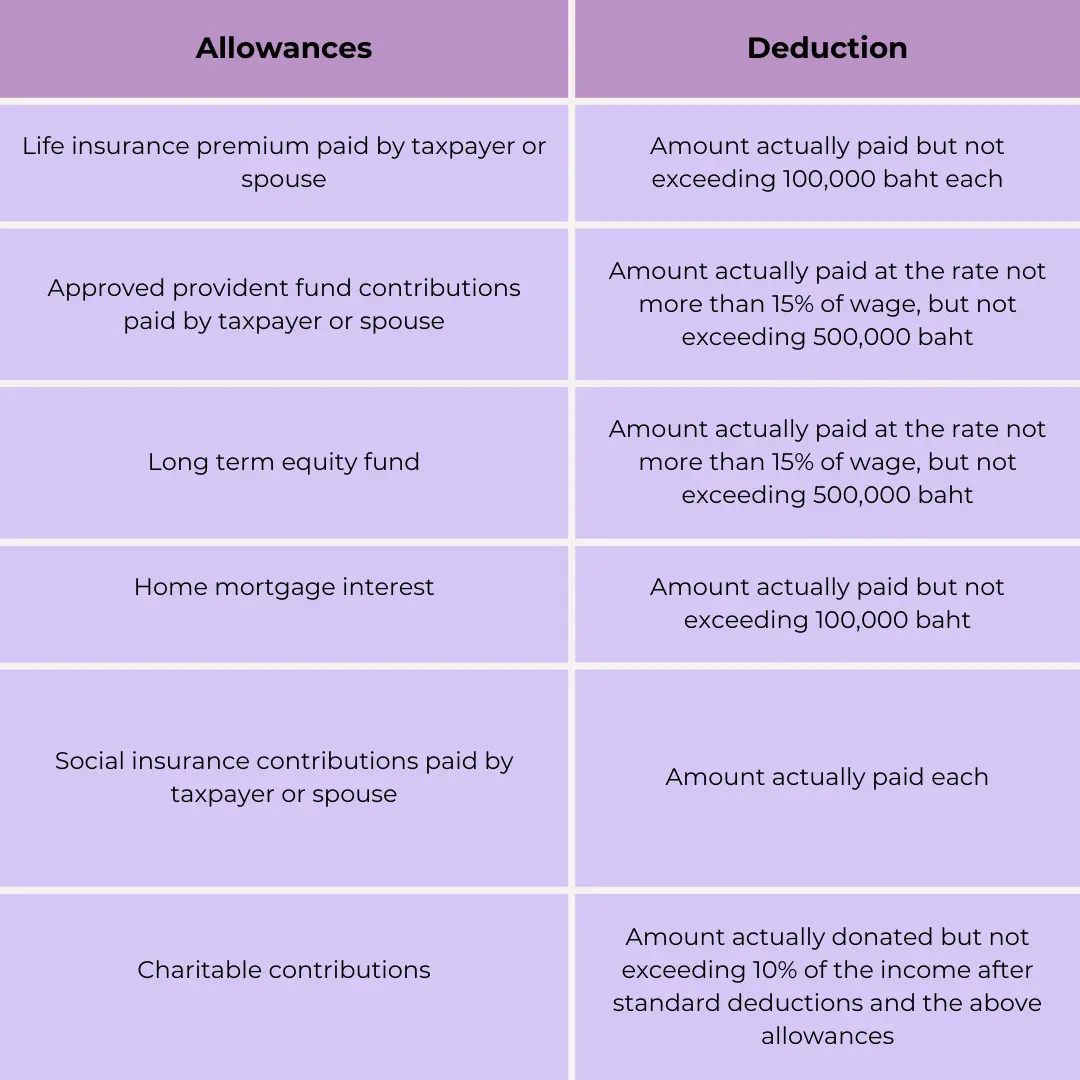

Deductibles on Personal Income Tax

Personal Income Tax Allowances

How is Personal Income Tax Calculated?

An individual earns a salary of THB 850,000 per year. They are eligible for the following deductions:

- Personal allowance: THB 60,000

- Single Tax Payer: THB 30,000

Total deductions: THB 90,000

- Taxable income = THB 850,000 – THB 90,000 = THB 760,000

Using the progressive tax rates:

- 0 – 150,000: 0% (tax = 0)

- 150,001 – 300,000: 5% (tax = THB 7,500)

- 300,001 – 500,000: 10% (tax = THB 20,000)

- 500,001 – 760,000: 15% (tax = THB 39,000)

Total tax = THB 66,500

Personal Income Tax For Foreigners

For foreigners living or working in Thailand, grasping the country’s income tax laws is crucial. Key aspects of the Thai tax system include residency-based tax obligations, specific rules for individuals on the Digital Nomad Visa (DTV), and the implications of double tax agreements on potential liabilities.

Given that tax requirements differ by country and regulations frequently change, consulting a qualified accountant is essential for the most accurate and up-to-date information.

Tax Resident Vs. Non Tax Resident

Tax Resident: If you stay in Thailand for 180 days or more in a calendar year, you are considered a tax resident. As a tax resident, you are subject to income tax on both Thai-sourced income and any foreign-sourced income that is brought into Thailand.

Non-Resident: If you stay in Thailand for less than 180 days in a calendar year, you are considered a non-resident. Non-residents are only taxed on Thai-sourced income, meaning any income earned or sourced from Thailand. Foreign-sourced income is not taxed if you are a non-resident.

Thai Vs. Foreign Sourced Income

Please be aware that although this policy has been put in place, there is still a lot of discussion around it and details will likely change. It is important to talk to a financial advisor.

You can download our full guide on the new Personal Income Tax rules for Thailand below:

Need help with accounts? Or not sure which income streams are taxable? Contact us for free consultation

Accounting Services and Tax

Bookkeeping

Monthly account keeping and filing. Tracking invoices, payments, receipts, payroll.

Monthly Tax Submission

Preparing and filing VAT (PP30) PND 90/91 PND 53 PND1 and other related taxes.

Annual Report

Auditing and submission of financial statement to the Ministry of Commerce (SorBorChor. 3)

Vat Registration

Business Value added Tax registration and processing.

Corporate Tax (CIT)

Mid-year corporate income tax (PND. 51) and year-end corporate income tax (PND 50) preparation and filing.

Tax ID

Application Tax ID number for business and personal.

PErsonal Income Tax (PIT)

Preparing and submit annual employee withholding tax (PND. 1 Kor) PND3 PND53

Social Security

Register company and staff to social security office. Monthly payment processing.

Advisory

Providing advice on accounting-tax in Thailand.

Frequently Asked Questions (FAQs)

What happens if I miss the personal income tax filing deadline in Thailand?

Missing the filing deadline may result in penalties, including fines and interest charges on any unpaid tax. It is essential to file as soon as possible to avoid additional fees.

Can I amend my personal income tax return after it has been filed?

Yes, if there are errors or omissions, you can file an amended return within a specified period. It’s important to correct any discrepancies promptly to avoid potential penalties.

Are there any special tax rates for self-employed individuals in Thailand?

Self-employed individuals in Thailand are taxed under the same progressive income tax rates as salaried employees, but they may be able to deduct business-related expenses from their taxable income.

How are bonuses taxed in Thailand?

Bonuses are considered part of an individual’s income and are taxed at the applicable progressive income tax rates. Employers typically withhold the tax on behalf of employees.

What is the process for paying personal income tax if I have multiple sources of income in Thailand?

If you have income from multiple sources, you must include all sources in your annual tax return. The total income will be taxed according to the progressive tax brackets, and any withholding tax paid will be credited against your total tax liability.