Thai Income Tax For Foreigners

Thailand has become a popular destination for foreigners. One key consideration for anyone planning to live or work in Thailand is understanding the country’s income tax laws. This article will provide an overview of the Thai tax system for foreigners, covering tax obligations based on residency, tax rules for foreigners on the Digital Nomad Visa (DTV), and how double tax agreements can impact your tax liabilities.

Be aware that different countries present different tax obligations and that tax rules change regularly. It is important to contact a qualified accountant to get the most accurate information.

Tax Residency: Defining a Tax Payer

The most important factor determining your tax obligations in Thailand is whether or not you are a tax resident. Thailand distinguishes between residents and non-residents for tax purposes.

- Tax Resident: If you stay in Thailand for 180 days or more in a calendar year, you are considered a tax resident. As a tax resident, you are subject to income tax on both Thai-sourced income and any foreign-sourced income that is brought into Thailand.

- Non-Resident: If you stay in Thailand for less than 180 days in a calendar year, you are considered a non-resident. Non-residents are only taxed on Thai-sourced income, meaning any income earned or sourced from Thailand. Foreign-sourced income is not taxed if you are a non-resident.

Thai Sourced Income vs Foreign Sourced Income

Thai Sourced Income: If a foreigner earns income from sources within Thailand (such as through employment, operating a business, or holding assets in Thailand), that income is subject to Thai income tax, regardless of whether it is paid inside or outside the country.

Foreign Sourced Income: For income generated from sources outside Thailand, it will be subject to Thai tax if two conditions are fulfilled: the income must have been earned in a tax year beginning on or after January 1, 2024, by a foreigner who stays in Thailand for 180 days or more in that calendar year, and the income must be brought into Thailand, even if the transfer happens in a subsequent year. (Please be aware that although this policy has been put in place, there is still a lot of discussion around it and details will likely change. It is important to talk to a financial advisor).

Example Tax Scenarios for Foreigners

Understanding how Thailand’s tax system works in practice can be tricky, so here are some example situations that show how residency and source of income affect tax liability:

EXAMPLE 1 Thai Sourced Income:

Sarah is a consultant from Australia who works with a Thai company for four months (120 days) in a calendar year. During this period, she earns THB 600,000 for the work she does while in Thailand.

-

Tax Implication:

Since Sarah stays in Thailand for less than 180 days, she is considered a non-resident. Non-residents are taxed only on their Thai-sourced income, which means the THB 600,000 she earned while working in Thailand will be subject to Thai income tax, based on the progressive rates. However, because she is not a resident, her foreign-sourced income is not taxed in Thailand.

EXAMPLE 2: Thai Sourced Income and Foreign Sourced Income

James, a UK citizen, works for a UK company but is assigned to Thailand for eight months (240 days) in a year. While in Thailand, James earns both his salary from the UK and an additional THB 1,200,000 for a side project he takes up with a Thai company.

- Tax Implication:

Since James stays in Thailand for more than 180 days, he is considered a Thai tax resident. His income from the Thai company is subject to Thai income tax. Additionally, if he brings that salary into Thailand, it could also be subject to Thai tax. As the UK and Thailand have a Double Tax Agreement (DTA) in place, James may be able to reduce or avoid double taxation by using tax credits.

EXAMPLE 3: Foreign Sourced Income

Emma, a software developer from the United States, moves to Thailand for seven months (210 days) but continues to work remotely for her US-based company on a DTV visa. She earns her income entirely from the US and pays US taxes on her salary.

- Tax Implication:

Since Emma stays in Thailand for more than 180 days within a calendar year, she is a Thai tax resident. However, if she does not bring her foreign income into Thailand, that income will not be taxed in Thailand. Since Emma pays taxes on her salary in the US, her foreign income remains exempt from Thai tax, provided it is not remitted into Thailand.

EXAMPLE 4: Foreign Sourced Income (NON-TAX RESIDENT)

Tom is a Canadian entrepreneur who spends four months (120 days) vacationing in Thailand. He earns his income solely from his business in Canada and pays taxes on that income in Canada. He does not have any income from Thailand during his stay.

- Since Tom stays in Thailand for less than 180 days and has no Thai-sourced income, he is a non-resident. As a result, he is not liable to pay any Thai taxes on his income, as it is earned abroad and not related to Thailand. He continues to pay taxes in Canada, where he resides and conducts his business.

The revenue department breakdown Foreign Based income tax and income tax for foreigners in Thailand here.

Double Tax Exemption (DTA)

Thailand has Double Tax Agreements (DTAs) with over 60 countries, which aim to prevent the same income from being taxed in both Thailand and the taxpayer’s home country. If you are a foreigner living in Thailand, you may be eligible to avoid double taxation by utilizing these agreements.

- Example Countries with DTA: The UK, US, Canada, Australia, Germany, Singapore, and many others.

- Tax Credits: DTAs usually provide for tax credits, where the tax you pay in one country can be used to offset your tax liability in the other country.

To benefit from a DTA, you will need to provide the relevant documentation, including tax residency certificates, to the Thai Revenue Department.

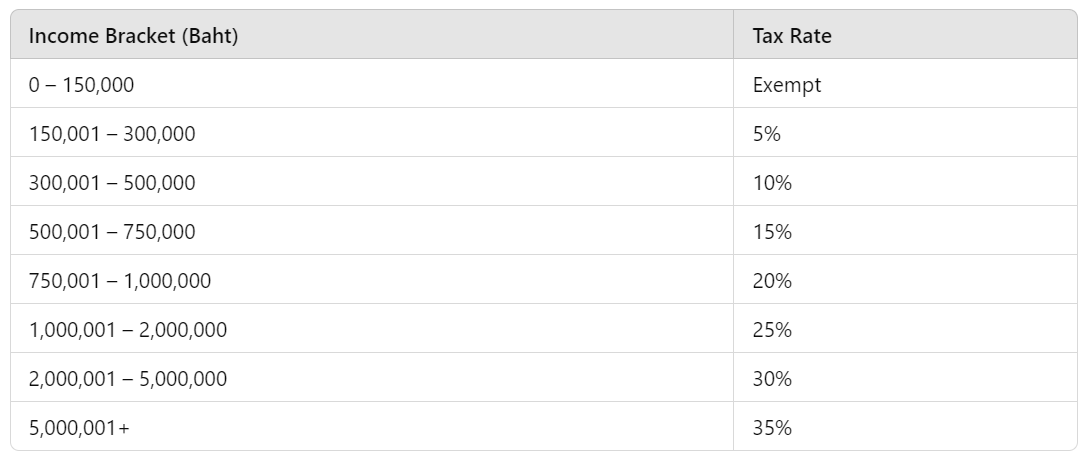

Thai Tax Rates in 2024

Thailand’s personal income tax rates are progressive, meaning the more you earn, the higher the tax rate you’ll pay. Here’s a table showing the current income tax rates for residents:

Non-residents are subject to the same tax rates on Thai-sourced income, but their foreign-sourced income is not taxed unless they become residents.

Tax Deductions in Thailand

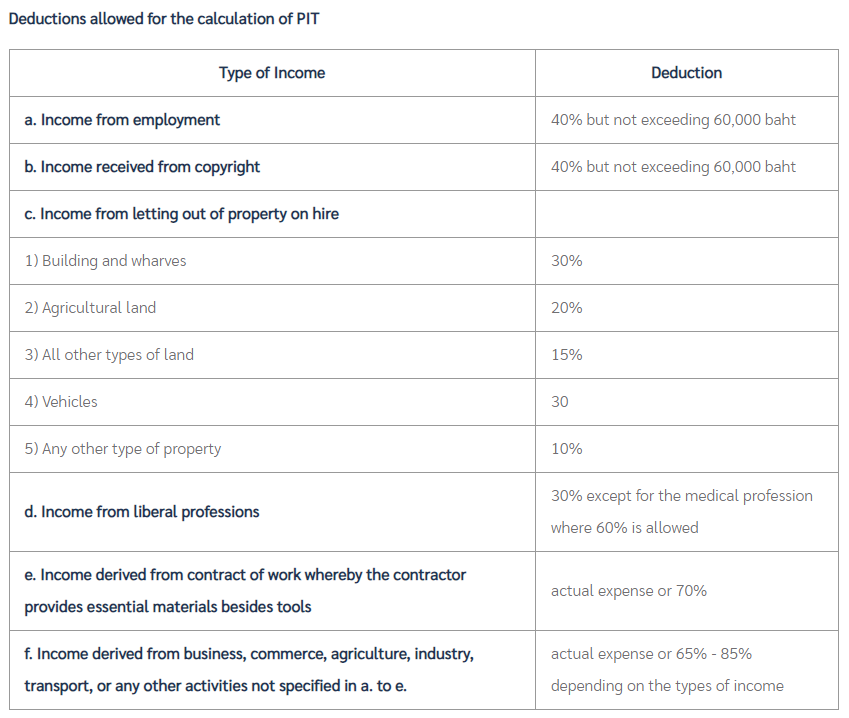

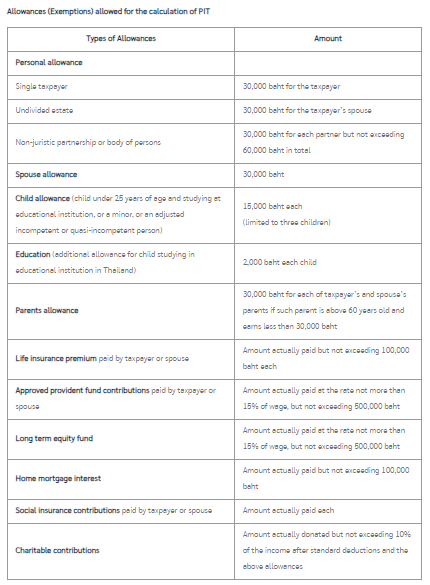

A Full list of Thai Tax allowanced can be found on the revenue departments website here. Below are snippets from the Revenue Department.

In Thailand, both residents and non-residents can benefit from various tax deductions and allowances that help reduce their taxable income.

- Example:

An individual earns a salary of THB 850,000 per year. They are eligible for the following deductions:

- Personal allowance: THB 60,000

- Single Tax Payer: THB 30,000

Total deductions: THB 90,000

- Taxable income = THB 850,000 – THB 90,000 = THB 760,000

Using the progressive tax rates:

- 0 – 150,000: 0% (tax = 0)

- 150,001 – 300,000: 5% (tax = THB 7,500)

- 300,001 – 500,000: 10% (tax = THB 20,000)

- 500,001 – 760,000: 15% (tax = THB 39,000)

Total tax = THB 66,500

If you aren’t sure of your tax resident status and want up to date advice contact a qualified accountant such as Attori Law.